1-Page Summary

Read the full summary for the full timelines of each company. Here we’ll discuss the high-level commonalities between both companies.

Both started as side projects, looking for the next big idea.

At Uber, Camp and Kalanick had both recently had their companies acquired. Camp was still busy at StumbleUpon, while Kalanick was enjoying his time away. From incorporation, over a year passed before they hired a CEO and invested real time.

At Airbnb, Chesky and Gebbia started it as a way to pay rent. It’s months before they really pick it as their main idea.

Both were rejected early on with a failure of imagination.

Uber’s potential investors often questioned the size of the black car market, not predicting how it could actually grow to the taxi market and even bigger. Others knew Uber was going to run into hostile local transportation laws. Others were worried about how uninvolved the founders were.

Airbnb investors were concerned about the size of the market, designer founders who didn’t fit the Silicon Valley engineer-founder mold, the legal liability of injured guests or destroyed homes, and concerns about whether anyone really wanted to sleep in strangers’ homes.

- Instead, with a more ambitious imagination, Airbnb can be defined as the larger “eBay, but for spaces,” or “the largest hotel chain in the world, without actually owning inventory” or “transforming a massive illiquid asset - space - into a peer-to-peer marketplace.”

Both grew virally, exhibited network effects, and kicked off powerful flywheels.

Uber had natural local virality - back then if you stepped out of a black car in front of your friends, they’d wonder what you were doing.

- More drivers caused less wait time and cheaper fares, which caused more riders to join and more rides to be taken, which stimulated more drivers.

Airbnb had natural international virality built in. Travelers who used the service would consider listing their own places.

- More users encouraged more inventory which encouraged lower prices which attracted more users.

Both circumvented local laws.

Uber

- Most cities regulate cabs and restrict the number of cab medallions available. By law only taxis can pick up people who hail on streets. Uber bypassed this regulation, allowing pickups by electronic hails, and using the phone as a fare meter.

- California wanted Uber to register as a limo company, but Uber argued it was not a fleet operator but rather an intermediary, much like Expedia wasn’t an airline.

- New York City required drivers of town cars to be affiliated with a base, like a professional fleet. Initially refusing to register Uber as a base, Kalanick eventually acquiesced.

Airbnb

- Large-scale property owners circumvented hotel laws requiring registration and taxes if they didn’t live in the unit being rented out for most of the year.

Both used popular consumer support to fight regulation.

Uber

- They fought local legislators by mobilizing users. Uber published phone numbers, email addresses, and Twitter handles of politicians and asked users to make their voices heard.

Airbnb

- Created a group called Peers to hold meetups among hosts to influence lawmakers.

- Generally, Airbnb didn’t have the same firepower Uber did. Hosts only rent out apartments a few times a year, unlike Uber drivers whose full time job could be to drive. And travelers by nature travel outside the city they live in, thus local regulation doesn’t affect their well being like Uber regulation would.

Both seeded the market with hacky growth tactics.

Both companies leaned on aggressive marketing tactics to gain market share and deal with competitors.

Uber called competitor cars en masse, sent them invitations to join Uber, then canceled rides.

In 2009, Airbnb used Craigslist, one of its main implicit rivals: 1) email anyone who posts a rental property on Craigslist asking them to join Airbnb; 2) in the reverse, allow Airbnb users to cross-post their listing to Craigslist frictionlessly. Craigslist eventually sent a cease-and-desist in 2012.

Shortform Introduction

The Upstarts alternates chapters between Uber and Airbnb and moves chronologically through time. To simplify the story, we created separate timelines for each company. We then created an exclusive chapter, discussing commonalities between both companies.

While the many timeline entries can seem a bit tedious, the fun way to read them is to put yourself into the founders’ shoes. Imagine that the events listed are happening to you month by month, year by year. You’ll appreciate how incredibly fast both Uber and Airbnb grew. Uber grew from a $5.3MM valuation to a $60MM in 8 months; then to a $290MM valuation just seven months later - 54x in 15 months!. Airbnb booked a total of 700,000 nights in fall 2010, then 5 million in Jan 2012, then 10 million in Jun 2012.

You’ll also appreciate the vast amount of controversy both companies dealt with, from regulators and incumbents to the local community and their own customers - all while trying to keep the wheels from falling off of their rocketship growth.

Uber History

2007-2009: Uber Begins

May 2007: eBay acquires Garrett Camp’s StumbleUpon. He starts living large and running into frictions with taxis in SF. He tries workarounds like calling multiple dispatchers at once, keeping a rolodex of gypsy cabs, and renting town cars for the entire night. He becomes enamored with a scene from a Bond film where Bond tracks a car coming to him on a phone.

Summer 2008: Apple announces the iPhone and the app store.

August 2008: Camp registers ubercab.com

November 17, 2008: Camp registers UberCab as an LLC in California. He starts doing market research on cabs and chauffeured transportation. His original plan is to buy five Mercedes and share the cost with friends.

December 2008: Camp meets with engineer Oscar Salazar, friend from grad school, who signs as first engineer. Soon after, Camp meets with Travis Kalanick at LeWeb in Paris.

- This is where Kalanick’s version of the origin story begins. In reality, Kalanick is only mildly interested at this time, having just sold his company Red Swoosh to Akamai and was drifting.

- Kalanick argues that instead of centrally owning cars, UberCab should distribute the app to drivers who own their own cars.

Early 2009: Uber is gestating slowly. Camp and Kalanick still see it as a side project. StumbleUpon is spun out of eBay, and Camp becomes CEO again.

- Early version of Uber used SMS dispatch. They enlist the help of a GPS company

Fall 2009: Uber has a working prototype. It’s buggy and barely works.

2010: Uber Gets Traction

Jan 5, 2010: Kalanick tweets about hiring a “entrepreneurial product mgr/biz-dev killer” and GE employee Ryan Graves replies. Two weeks later, he moves to SF from Chicago to run Uber as its first CEO. Kalanick is now spending about 20 hours/week and listed as a “mega-adviser”.

June 2010: UberCab goes live in iOS. They get rejected by most investors, including 150 investors on AngelList. They raise $1.3MM at $5.3MM valuation.

- A handful of notable investors come in early (Chris Sacca, Mitch Kapor, Jason Calacanis, Alfred Lin, David Cohen, Naval Ravikant) but many investors still had serious doubts about Uber.

July 5 2010: TechCrunch writes about UberCab.

Fall 2010: Uber is growing virally. If you step out of a black car, your friends will ask what in the world you’re doing.

October 2010: state and SF government officials give Uber a cease-and-desist, threatening penalties of $5,000 per ride and 90 days in jail for each day the company remained operating.

- This fight is the impetus for Kalanick to join Uber full-time, recalling his legal fights at Red Swoosh (a peer-to-peer file-sharing company). He negotiates a 23% stake in Uber for joining.

- Ultimately government officials agree with Uber’s claim that it was merely an intermediary between drivers and riders, not an actual fleet operator (much like Kayak is not an airline)

- Uber rides grow by 30% each month..

New Year’s Eve 2010: Uber faces continuous issues with producing enough ride supply for swings in rider demand. In a precursor to Surge, Uber raises fares to twice the usual rate in SF.

2011: Uber Expands

Feb 2011: Bill Gurley and Benchmark lead a $11MM Series A at a $60MM valuation.

- Gurley had been watching the space for a while now, having tried and failed with Taxi Magic and Cabulous.

Early 2011: Uber launches its first expansion outside SF in NYC, hiring Matthew Kochman as general manager.

- Kochman faces continuous problems with driver shortages and seeing zero cars available on the app. He tries to recruit towncar fleets, as Uber had done in SF, but has little success given that drivers would eventually disintermediate the fleets by joining Uber directly.

- Kochman eventually realizes his equity was allocated before the Series A, not after, diluting his share. He emails investors citing lack of confidence in leadership, hoping for a shuffling that would put him in Kalanick’s place. When they refuse, he quits in September 2011. (His total options, which he received none of due to the vesting cliff, would eventually be worth over $100MM).

Jul 2011: Uber expands to Seattle, headed by Austin Geidt and Ryan Graves.

- They continue developing their city playbook in a Google doc, consisting of their manager structure and strategies to recruit drivers through Yelp and airport waiting lots.

- Kalanick continues tracking daily results from each market and comparing to the early SF growth patterns. The general manager is tasked with growing faster than SF did.

Oct 2011: After Kalanick’s early resistance, Uber registers as a base in NYC to placate the government.

- NYC is still lacking on the supply side of drivers, so they start a new strategy breaking up the city into micro-cities like Wall St and SoHo. They then manually send drivers to places where demand is highest. This ensures a better user experience, which improves word-of-mouth

Sept 2011: Uber gets $9 million in fares, keeping $1.8 million in commissions. 9000 customers are using the app, with 80% in SF. Uber sets out to raise money.

- Kalanick’s favorite is Andreessen Horowitz, who initially offers a $300MM valuation. But A16Z later lowers the offer to $220MM and asks for a large option pool.

- Kalanick instead goes to Shervin Pishevar at Menlo Ventures, offering $25MM at $290MM. Pishevar doesn’t even ask for a board seat, citing its immense growth (3.5 rides per month per user, and each user showing the app to 7 friends).

- Travis gets advice that “you don’t need validation from a venture capitalist - now it’s about getting the cheapest capital you can.” He goes with Pishevar, who also ropes in celebrity friends like Ashton Kutcher, Britney Spears, Jay Z.

Throughout 2010-11: Chris Sacca employs his strategy of buying shares from other investors, as he did with Twitter. Kalanick refuses to authorize these sales.

- Sacca then unwittingly signs a contract that took away some board rights from First Round Capital. WIth tension in the air, he intimates that he may have to sue Uber. Their relationship sours and Sacca is banned from Uber board meetings - they have yet to reconcile.

New Year’s 2011: After experimenting with manual surge pricing (where Travis would manually plug in new fares into software), Uber unveils an automated surge pricing algorithm. Prices rise up to 7x the normal rate in NYC and SF, causing $100 rides for short rides.

- Travis responds defensively, tweeting “the price is right there before you request.” This feeds the press fire.

2012: Competition and Legal Troubles

Early 2012: Uber is in a dozen cities with 50 employees, half in the field.

Jan 13, 2012: DC officials declare Uber illegal. They organize a press conference, order an Uber, fine the driver, and impound the car.

- DC business is growing by 30-40% each month, hitting $7 million in gross bookings by April.

2012: Michael Pao, general manager in Boston, A/B tests surge pricing with drivers. He shows that drivers with higher fares stayed online longer during peak times, possibly increasing driver supply by 80% and lowering unfulfilled requests by 60%. This convinces Travis to roll out surge pricing universally and at all times.

March 29, 2012: Hailo, a taxi hailing app, raises $17MM and announces plans to launch to Uber strongholds - Chicago, Boston, New York. Uber goes on the offense.

- Some Uber employees question bringing taxis on Uber and diluting the luxury brand of Uber. “I’m going to literally flip this table if anyone says one more time they are worried about destroying the brand. The luxury of Uber is about time and convenience. It’s not about the car.”

April 18, 2012: Uber launches Uber Taxi, beating Hailo by 5 months.

June 2012: Zimride launches Lyft with a unique set of rituals: riders were told to sit in the front and give the driver a fist-bump; conversation was encouraged; pink carstaches were added to vehicle grilles.

- Lyft commenting on Uber: “We didn’t think of them as similar to us. Our vision has always been every car, every driver, and never ‘everyone’s private driver.’ We didn’t want to be a better taxi; we wanted to replace car ownership.”

- Ironically, Kalanick actually believes Lyft and Sidecar are illegal and resists implementing ridesharing.

July 4, 2012: Uber launches UberSUV and UberX, originally a fleet of hybrids. UberX is envisioned as employing professional drivers with taxi licenses.

- The name UberX is actually a placeholder, the best they could come up with at the time.

Jul 10, 2012: DC proposes a compromise, legally allowing Uber to operate but adding a price floor requiring Uber to charge several times the rate of a cab. Kalanick believes a price floor is a non-starter, especially as competitors like Hailo are going to require price cuts.

- He starts the now-famous strategy of mobilizing the consumer base to contact the city council, accusing them of “price fixing” and protecting a corrupt industry. He publishes the phone numbers, email addresses, and Twitter handles of council members.

- WIthin 24 hours, the DC council members receive 50,000 emails and 37,000 tweets. They back down on the compromise.

Fall 2012: Uber has >100 employees, moves into new offices at 405 Howard St, and has a $100MM revenue run rate.

Fall 2012: California sends cease-and-desist letters to Lyft and Sidecar.

Dec 4, 2012: In DC, an amendment masses allowing a new class of sedans that could be dispatched by smartphone and could charge by time and distance - a pure victory for Uber, and a revolution for their approach to legislators. “Our product is so superior to the status quo that if we give people the opportunity to try it, in any place in the world where government has to be at least somewhat responsive to the people, they will demand it and defend its right to exist.”

2013-2016: Uber Marches On, With Continuing Controversy

Jan 2013: California reaches an agreement with Lyft and Sidecar, requiring basic safety requirements, insurance, and background checks. Both expand quickly into new cities.

- Quickly, Uber signs the same agreement with California, turning UberX into a ridesharing service. They cover drivers with a million-dollar liability policy, held by a subsidiary called Rasier - German for “shave” (a jab at the Lyft mustache).

- Kalanick recognizes that Lyft and Sidecar paved the way in regulation, but he also regrets waiting on the sidelines. “We are not going to let this happen ever again.”

Fall 2013: Uber is growing 20% each month. UberX is 25% less expensive than taxis, and Uber Black and Uber SUV are subsidizing UberX. They move to new offices in 706 Mission St.

Aug 2013: Kalanick looks to raise more money from a partner who can amplify Uber’s global expansion. Google impresses him with a self-driving car demo and Larry Page’s promise to work together on Google Maps. Uber raises $258MM from Google and $88MM from TPG Capital (whose partner could help with regulatory problems).

- Jay Z invests $2MM, but wants a larger stake and wires Uber $5MM. Uber returns the difference.

Dec 2013: Uber is sued in California and Massachusetts for misclassification of contractors (they should be employees, plaintiffs argue).

Dec 31 2013: an Uber driver hits and kills a 6-year-old girl walking across the sidewalk. Press is negative. Uber initially defends, saying the driver wasn’t on a ride at the time. This prompts Uber and Lyft to introduce $100k in supplementary insurance for when drivers don’t have passengers.

Beginning of 2014: Uber has booked 200 million rides.

Jan 24 2014: Israeli startup Gett reports that Uber employees ordered and canceled >100 of its cars and texted drivers to switch to Uber.

Feb 2014: Kalanick is featured in GQ describing how founding Uber gets him women and calls it “Boober.” This is panned.

Early 2014: Uber cuts UberX fares by up to 30% in select markets, hoping to boost demand during the winter slowdown and grow past Lyft.

Spring 2014: Uber begins financing leases for new cars for drivers. A % of driver earnings go toward paying off the lease. This brings more drivers into supply, and it also cements loyalty for Uber.

2014: Lyft representatives approach Uber about merging. Lyft wants an 18% stake in Uber, but Uber offers 8%. The deal falls apart, and Lyft raises $250MM soon after.

Jun 2014: Uber raises a $1.4B Series D at $18B valuation (up from $3.5B in Aug 2013) from Fidelity, Wellington, Blackrock, and Kleiner Perkins.

June 11 2014: London taxi drivers gridlock the city, protesting Uber. Ironically, Uber reports signups jumped 850% after the strike, a classic Streisand effect.

Summer 2014: Lyft COO VanderZanden, disillusioned with Lyft’s prospects, approaches Lyft board members about taking over as CEO and talks to Uber privately about merging. He resigns and joins Uber a few weeks later.

Summer 2014: Uber moves headquarters again (7th time since founding) to a former Bank of America building on Market St.

Oct 2014: Sarah Lacy of PandoDaily criticizes Uber for a promo campaign featuring attractive female drivers, with slogans like “Who said women don’t know how to drive?” She reports deleting Uber from her phone.

- Some within Uber are outraged at this coverage, suggesting Uber makes travel safer for women everywhere.

- A few weeks later, at a private dinner with journalists, Emil Michael proposes funding responses to negative articles and revealing private details about reporters, particularly targeting Sarah Lacy’s personal life. This brash threat to invade privacy is published in Buzzfeed.

- The BuzzFeed article also includes a detail about God View, where any Uber employee can track the location of any user.

Fall 2014: Google informs Kalanick that Google was planning to roll out its driverless cars in its own on-demand service. Worried about overreliance on a partner (as IBM relied on Microsoft and Yahoo relied on Google), Uber asks Google board members and observers to stop attending. Uber starts planning its own self-driving research.

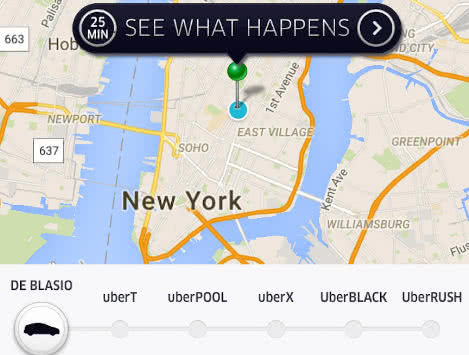

June 2015: NYC proposes a bill to limit the growth of Uber/Lyft drivers by 1% a month. This would cripple their growth.

- Uber launches a popular support campaign including mailings, robocalls, TV ads featuring minorities saying they’d lose their Uber jobs, and a feature called “De Blasio’s Uber” that showed a 25-minute pickup.

- The bill is dropped.

Summer 2015: Uber’s Paris offices are raided and drivers fined; Milan outlaws UberPop (EU version of UberX). Cities Spain, Germany eventually also become hostile to Uber.

Beginning of 2016: Uber has booked 1 billion rides. 6 months later, it books 2 billion rides.

June 2016: Uber raises $3.5B from Saudi Arabia, at $68B valuation.

End of 2016: Uber is in 450 major cities around the world.

China Ridesharing History

June 2012: Cheng Wei leaves Alibaba and founds Didi Dache after learning of the Hailo-Uber battle.

- Among 30+ ridesharing competitors in China, Didi differentiates strategy by giving their free app to younger drivers who already had phones, rather than giving smartphones to drivers.

April 2013: Kuaidi Dache raises funding from Alibaba. In response, Didi quickly raises from Tencent.

- In China, dominant share is often established by the startup with the strongest connection to the big 3 - Tencent, Baidu, and Alibaba.

Summer 2013: Kalanick travels to China to try a pilot in Beijing. He meets Cheng Wei and calls him “special...a massive cut above anyone else in the industry.”

Nov 2013: Cheng Wei tries to raise capital in Didi, only to be rejected by multiple investors. He attributes it to Didi’s high burn rate (in 2014, Didi burnt through $100,000 every day).

Feb 2014: Tencent has a big hit with the Red Envelope app, which allows gifting of money as per Chinese custom. Suddenly Alibaba and Tencent get into a mobile payments war, with Didi and Kuaidi as strategic pieces.

Early 2014: Uber launches its black-car service in Shanghai, Beijing, Guangzhou, and Shenzhen.

Oct 2014: Uber introduces UberX in 4 Chinese cities. In December, it raises from Baidu.

Jan 2015: China’s Ministry of Transport rules that private car owners are not allowed to use ride-hailing apps for profit. However, Uber, Didi, and other apps are still allowed to operate, possibly because it helped alleviate transportation issues.

Feb 2015: After burning a lot of money, Didi and Kuaidi decide to merge to form Didi Kuaidi, with Didi controlling 60% of the merged company.

Spring 2015: Kalanick meets with Cheng Wei and asks for a 40% stake in the company, in return for ceding China to Didi. If refused, Kalanick would hand Didi an “embarrassing defeat.” Didi rejects the proposal.

May 2015: Didi says it’ll give away 1 billion RMB in rides. Uber matches it.

Sept 2015: Didi invests $100MM in Lyft. It also establishes an anti-Uber coalition with Lyft, Ola in India, and Grab Taxi in Southeast Asia.

2016: Didi Chuxing (renamed) raises $7B in 2016 and reaches 5,000 employees. It claims an 85% market share in China and is active in 400 cities, while Uber is only in 100. At their peaks, Didi and Uber are both losing $1B per year in China.

Jul 2016: Uber finally cedes China to Didi, getting 17% in Didi and a $1B investment.

Airbnb History

2007-2009: Airbnb Begins

Sept 2007: Brian Chesky is in Los Angeles, working at a design firm and making furniture on the side. Joe Gebbia is currently working at a book publisher and making CritBuns cushions on the side. Gebbia sends Chesky a cushion, and Chesky makes up his mind to live in SF. Strapped for cash, Chesky asks if he can rent the couch for $500/mo instead of paying for a bedroom. Gebbia declines, saying Chesky needs to pay for a full bedroom to make bills work.

Sept 22 2007: A design conference in SF is coming up. Gebbia sends Chesky an email proposing a “way to make a few bucks - turning our place into a designer’s bed and breakfast.”

Sept 25 2007: They launch airbedandbreakfast.com with wordpress, and circulate the site to city design blogs.

Oct 2007: Amol Surve, is their first guest. The idea doesn’t immediately strike them as THE idea - they continue brainstorming ideas for new companies over the next three months.

March 2008: For South by Southwest, they launch a new version of the website, with Nathan Blecharczyk as engineer. They email anyone in Austin who listed their room on Craigslist to sign up for AirBed & Breakfast. They get two reservations - one being Chesky. Chesky meets with Michael Seibel of Justin.tv who offers to introduce him to angel investors.

April-August 2008: Blecharczyk moves back to Boston, considering Airbnb just a side project. They plan for Denver’s DNC in August and launch a 3rd version of the site, making search easier. They meet with angels and VCs, all of whom pass. Chesky and Gebbia are getting deeper into debt.

August 2008: 80 people use service to stay in Denver, and they get press mentions, but after DNC the # of reservations per week drops below ten. To keep funding themselves during the debates, they create Obama-O’s and Cap’n McCain cereal boxes. They get press and sell out in three days, earning $39 * 500 boxes = ~$20k.

- Beforehand, Nate and Seibel are dismayed, thinking it’s a dumb idea and a distraction. Paul Graham later uses this as an exemplar of grit.

Winter 2008: Airbnb enters startup incubator YCombinator. In what is now part of startup lore, Airbnb notices that hosts in New York aren’t advertising their properties appealingly. Constrained by budget, Chesky and Gebbia personally visit hosts in the guise of professional photographers and take photos to improve listings.

March 2009: Greg McAdoo at Sequoia convinces Airbnb not to pitch at YC demo day, instead investing $585k for a 20% stake.

Through 2009: Chesky feels success isn’t coming quickly enough. “When you’re starting a company it never goes at the pace you want...You start, you build it, and you think everyone’s going to care. But no one cares, not even your friends.”

Late 2009: Airbnb starts two growth campaigns centered around Craigslist: 1) email anyone who posts a rental property on Craigslist; 2) in the reverse, allow Airbnb users to cross-post their Airbnb listing to Craigslist frictionlessly. It also optimizes Google and Facebook ads, delivering customized ads like “Better than couchsurfing.com!” and “Rent your room to a Yogi” (based on Facebook interest) respectively.

2010-2012: Airbnb Grows

Summer 2010: NYC votes on a law making short-term subletting illegal.

Fall of 2010: Airbnb has booked 700,000 nights in 8,000 cities. It’s introduced an iPhone app. It raises a $7.2MM Series A from Reid Hoffman and Greylock.

April 2011: German company Rocket Internet launches Wimdu, a clone of Airbnb. Soon after Oliver Samwer meets with Airbnb founders and investors, showing their formidable operations and financial backing, and offers an ultimatum: merge with us or we will make your life miserable.

Jul 2011: Airbnb bookings have been growing 40-50% every month. Andreessen Horowitz leads a $112MM Series B at $1.3B valuation, with Jeff Jordan, a former eBay president.

Jul 2011: Host EJ publishes an account of home destruction by a guest: “they smashed a hole through a locked closet door...they used my fireplace to reduce mounds of stuff to ash.” Chesky responds in Techcrunch that Airbnb had been in close contact. EJ rebuts, saying compensation never came. Tech press has a field week piling on.

- Airbnb previously had a libertarian view of users self-policing each other and removing bad actors through reviews. Now they offered a host of improvements: a $50,000 damage guarantee, 24-hour customer service hotline, and a new trust and safety department. (Next year the guarantee would increase to $1 million).

Aug 2011: Airbnb moves to new offices at 99 Rhode Island St. Chesky rejects Wimdu’s offer to merge and starts international expansion, opening offices in 10+ cities.

Jan 2012: Airbnb announces the opening of its international offices. Its approach vs Wimdu is to export trust and a “soul in the business.” Ultimately, US travelers to Europe didn’t care about Wimdu’s early lead, and European travelers to the US had to use Airbnb.

- Airbnb also reaches 5 million nights booked.

Jun 2012: Airbnb reaches 10 million nights booked.

2013-2016: Airbnb Growth and Controversies

Late 2012-2013: A NYC host Nigel Warren is fined over $40,000 for fees. Initially getting little help from Airbnb, he gets covered in the New York Times, after which he gets more serious legal support.

- Warren eventually has most charges dropped and the fee reduced to $2,400, but Airbnb believes any punishment would set a bad precedent globally. Airbnb appeals and Warren is exonerated, feeling “happy but not grateful” given they swooped in primarily to protect their business.

Aug 2013: NYC subpoenas Airbnb to provide contact info and earnings for all Airbnb hosts in New York State.

- In Oct 2013, Airbnb files a motion to reject the subpoena. It also commissions a survey of Airbnb’s economic impact on NYC, arguing it generates $632MM in activity in one year, and that Airbnb guests stay longer and spend more than hotel guests.

2013: Airbnb has a $250MM revenue run rate and 500 employees.

Oct 2013: Airbnb raises a $200MM Series C from Founders Fund at a $2.5B valuation (up from $1.3B in Jul 2011).

Dec 2013: Airbnb moves to 72k square feet of office space at 888 Brannan St. It features meeting rooms modeled after Airbnb listings around the world and after the founders’ original apartment. It spends more than $50MM on renovation and $110MM on a 10-year lease.

Dec 30 2013: A guest dies of carbon monoxide poisoning in an Airbnb in Taipei. The family wants to sue Airbnb and settles for $2MM. This prompts Airbnb to require smoke and CO detectors, though there is no enforcement.

April 2014: Back in NYC legal issues, a judge rules the subpoena is too broad. Airbnb agrees to release a limited dataset. The attorney general later concludes that ⅔ of Airbnb rentals violated city law.

April 2014: Airbnb raises a $475MM Series D at $10B from T. Rowe Price, TPG, and Sherpa Capital.

Summer 2014: Portland is the first city to strike a deal with Airbnb, legalizing short-term rentals (below 90 days when the owner isn’t present) and requiring registration with the city. In return, Airbnb collects a 11.% lodging tax.

- Airbnb starts rolling out similar structures with cities worldwide, offering taxes as an olive branch.

- In reality Airbnb does little to enforce the regulation, not requiring a registration ID to sign up.

July 2015: Chesky travels with Obama to Kenya for an entrepreneurship summit.

Fall 2015: In San Francisco, Proposition F is put on the ballot. It reduces rentable host-absent days from 90 to 75, makes renting entire apartments illegal, and allows citizens to sue neighbors.

- Airbnb releases snarky ads with test like “Dear public library system: we hope you use some of the $12 million in hotel taxes to keep the library open later.” These go over very poorly.

- After campaigning from both sides, it is rejected 55-45%.

May 2016: Airbnb is sued for racial discrimination on the site. The suit is blocked because of an arbitration clause, but Airbnb releases a plan to reduce discrimination.

June 2016: SF passes an ordinance fining Airbnb anytime a host violated a local law. NYC passes a bill fining hosts who list entire properties without a host present for short-term rentals less than 30 days.

Mid-2016: Airbnb is booking 1.3 million guests a night, up from 1 million on NYE 2016 and 0.55 million on NYE 2015. It has 2600 workers.

Aug 2016: Airbnb has its best night ever, with 1.8 million bookings. 1 million listings are available by instant-book, roughly equal to Marriott’s number of rooms.

Nov 2016: Airbnb launches Trips, with the vision of producing locally-authentic itineraries to restaurants, tickets, and transportation - and taking a commission on bookings. Chesky sees this as the equivalent of Amazon expanding from selling only books to all products.

Commonalities Between Uber & Airbnb

In this Shortform exclusive section, we discuss commonalities between Uber and Airbnb. Beyond their similarities in business model as two-sided marketplaces, they also faced similar pressures in early investor skepticism, government regulation, and frictions with drivers (suppliers and hosts).

Both started as side projects, looking for the next big idea.

At Uber, Camp and Kalanick had both recently had their companies acquired. Camp was still busy at StumbleUpon, while Kalanick was enjoying his time away. From incorporation, over a year passed before they hired a CEO and invested real time.

At Airbnb, Chesky and Gebbia started it as a way to pay rent. It’s months before they really pick it as their main idea.

Both were rejected early on with a failure of imagination.

Uber’s potential investors often questioned the size of the black car market, not predicting how it could actually grow to the taxi market and even bigger. Others knew Uber was going to run into hostile local transportation laws. Others were worried about how uninvolved the founders were.

Airbnb investors were concerned about the size of the market, designer founders who didn’t fit the Silicon Valley engineer-founder mold, the legal liability of injured guests or destroyed homes, and concerns about whether anyone really wanted to sleep in strangers’ homes.

- Instead, with a more ambitious imagination, Airbnb can be defined as the larger “eBay, but for spaces,” or “the largest hotel chain in the world, without actually owning inventory” or “transforming a massive illiquid asset - space - into a peer-to-peer marketplace.”

Both companies were far from the first to have the concept.

Uber had the following companies as precursors and competitors:

- Food delivery startup SeamlessWeb launched Seamless Wheels in 2003 as a way to book and expense town cars. Investors balked at black cars being niche and primarily an NYC product. They also received a threatening call, fearing that the Russian mafia was running the black car service. Without smartphones, coordination between drivers and riders was janky. SeamlessWeb was acquired in 2006 and Wheels is shut down.

- Failure diagnosis: timing was too early

- Zimride

- In fall 2005, Zimride was founded to enable carpooling (literal ridesharing). With Facebook’s recent rise, they established real identities to overcome the trust barrier. Popular in college campuses, users used it mainly to carpool on long-haul rides.

- In summer 2009, they took funding from Floodgate. Their model was to sell custom versions of the app to universities and companies.

- By 2011, they realized Zimride wasn’t going to be huge. Most users didn’t use Zimride more than a few times a year. Carpooling on commutes or long hauls just wasn’t frequent enough.

- In early 2012, they pivoted to allow short-distance travel within cities. Seeing a giant orange mustache in a cubicle, they gave each driver a pink mustache to stand out and look friendlier. They became Lyft.

- Lyft and Sidecar were actually earlier to market with ridesharing (unlicensed drivers with their own vehicles). They paved the way in regulation for Uber with UberX in 2013.

- Taxi Magic

- Taxi Magic began in 2007 to allow booking taxis on-demand. In June 2008 (when the iPhone launches), Taxi Magic received tens of thousands of downloads a day. Instead of disrupting cabs, it worked with them, integrating into their software (thus handicapping Taxi Magic from having accurate locations). It expanded to 25 cities in 2008, 2 years before UberCab launched in SF.

- Unfortunately, their main partners - fleet owners - were indifferent about riders, since to riders the cabs were largely commoditized and thus didn’t have brand loyalty. The fleet owners were also incentivized flatly, since they were paid a flat fee by drivers to rent a medallion or car.

- Service also suffered - rides were assigned to the driver who had waited longest, not the closest one Cabs might ignore the dispatch to pick up a pricier fare.

- In summer 2009, Bill Gurley offers to invest $8MM at $32MM, but Taxi Magic turns it down.

- They bet on partnering with taxis because they believed that the regulatory environment would hold. They weren’t aware the rules had changed to allow popular consumer support to override protected interests.

- Cabulous

- In fall 2009, Cabulous launched from a Best Buy incubator. The goal was to empower taxi drivers to boost earnings. It allowed riders to see cabs on a map and hail cabs. Riders still paid drivers manually.

- However, Cabulous didn’t control supply of drivers and thus couldn’t scale with demand. In peak times like Friday night, drivers wouldn’t even turn on the app.

- In late 2009, Cabulous raised less than a million dollars (later realized to be too little to compete).

- They had several conversations with Uber, but Cabulous insisted on regulation and taxi rights. The founder argued with Graves about using the iPhone as a taximeter and flouting laws.

- In 2011, the founder left. Cabulous was rebranded Flywheel.

- Hailo

- Hailo recruited London cabbies to book cabs electronically. It charged no extra commission from the riders.

- By early 2012, Hailo had 200,000 downloads and 2,000 drivers.

- After raising $17MM from Accel in Mar 2012, Hailo announced a plan to expand to US cities - Chicago, Boston, New York. Uber felt threatened and quickly launched a taxi service on April 18, 2012, beating Hailo by months.

- Hailo and Uber had philosophical differences. Hailo wanted to use existing supply of taxis and make cabbies more productive, believing it was enough to meet demand (given that many drivers were actually idle much of the time). Uber wanted to build a new network of professional drivers, believing the supply of medallions was artificially restricted, and real demand was going to grow.

- Uber ended up being more correct - with rides more convenient, people stopped driving their cars, and yellow-taxi apps couldn’t keep up with demand.

- Ridesharing

- Ridesharing was a standalone category in Craigslist and in TaskRabbit, where rides to the airport made up 10% of early traffic.

- Sidecar, launched in Feb 2012, pioneered ridesharing.

Airbnb

- Couchsurfing opened in 2004 with pure motives to allow travelers to sleep cheaply and meet people. It began as a nonprofit run largely by volunteers and receiving fees from new members. By 2008, they had become outdated and the experience suffered compared to other web standards.

- They realized Airbnb was a threat - Chesky remembered being unimpressed. “There could be fifty companies that makes chairs but it doesn’t matter. The one who wins is the one who makes the best one.” Comparing couchsurfing and Airbnb was “like saying every piece of furniture is the same.”

- In 2010, Couchsurfing lost nonprofit status and had to raise capital. After Benchmark invested, they fired most of the staff, and it was downhill from there.

Both set up playbooks for new office expansion.

Both companies had to expand methodically in each new city, and they created their own proprietary playbooks for how to get traciton quickly.

Uber playbook

- Set up a triumvirate structure for each city:

- General manager was accountable for overall growth.

- Operations manager grew driver supply.

- Community manager stimulated demand in riders.

- Recruit drivers through Yelp listings, online directories, or airport waiting lots.

- Launch party should bring together media and local celebrities.

- A celebrity should be the first rider and be promoted in a blog post.

- With restricted driver supply, use the SoHo strategy of breaking up the city into microcities/neighborhoods (like Upper East Side and SoHo) and incentivizing drivers to pick up in those areas.

Airbnb provided tools to monitor the local business and gave an “office in a box,” containing props like a portable Ping-Pong table and the book Delivering Happiness.

Both grew virally, exhibited network effects, and kicked off powerful flywheels.

Uber had natural local virality - back then if you stepped out of a black car in front of your friends, they’d wonder what you were doing.

- More drivers caused less wait time and cheaper fares, which caused more riders to join and more rides to be taken, which stimulated more drivers.

Airbnb had natural international virality built in. Travelers who used the service would consider listing their own places.

- More users encouraged more inventory which encouraged lower prices which attracted more users.

Both circumvented local laws.

Uber

- Most cities regulate cabs and restrict the number of cab medallions available. By law only taxis can pick up people who hail on streets. Uber bypassed this regulation, allowing pickups by electronic hails, and using the phone as a fare meter.

- California wanted Uber to register as a limo company, but Uber argued it was not a fleet operator but rather an intermediary, much like Expedia wasn’t an airline.

- New York City required drivers of town cars to be affiliated with a base, like a professional fleet. Initially refusing to register Uber as a base, Kalanick eventually acquiesced.

Airbnb

- Large-scale property owners circumvented hotel laws requiring registration and taxes if they didn’t live in the unit being rented out for most of the year.

Both used popular consumer support to fight regulation.

Uber

- They fought local legislators by mobilizing users. Uber published phone numbers, email addresses, and Twitter handles of politicians and asked users to make their voices heard.

Airbnb

- Created a group called Peers to hold meetups among hosts to influence lawmakers.

- Generally, Airbnb didn’t have the same firepower Uber did. Hosts only rent out apartments a few times a year, unlike Uber drivers whose full time job could be to drive. And travelers by nature travel outside the city they live in, thus local regulation doesn’t affect their well being like Uber regulation would.

Both stirred conflicts between users and incumbents/locals.

Uber pitted:

- Drivers who made a living and customers who had access to reliable, affordable transportation

- Versus taxi incumbents, regulators who worried about safety (and protected interests), and drivers who wanted more benefits.

Airbnb pitted:

- Hosts who used their homes to support their livelihoods/passion projects, users who enjoyed friendly travel, and property owners

- Versus locals who saw Airbnb inflating rental prices and contributing to gentrification, hotel trade groups, and neighbors tired of loud guests.

Both built trust into the network, neutralizing the advantage of incumbents.

In the early days, a major reason people preferred taxis and hotels was the trust in their standard of quality. If a bad event happened, recourse could be possible.

Uber and Airbnb both built trust into their system, through the form of reviews and reputations. The star rating on both services neutralized the trust advantage that incumbent taxis and hotels had.

Both seeded the market with hacky growth tactics.

Both companies leaned on aggressive marketing tactics to gain market share and deal with competitors.

Uber called competitor cars en masse, sent them invitations to join Uber, then canceled rides.

In 2009, Airbnb used Craigslist, one of its main implicit rivals: 1) email anyone who posts a rental property on Craigslist asking them to join Airbnb; 2) in the reverse, allow Airbnb users to cross-post their listing to Craigslist frictionlessly. Craigslist eventually sent a cease-and-desist in 2012.

Company Values

Uber

- Customer obsession

- Make magic

- Big bold bets

- Inside out

- Champion’s mind-set

- Optimistic leadership

- Superpumped

- Be an owner, not a renter

- Meritocracy and toe-stepping

- Let builders build

- Always be hustlin’

- Celebrate cities

- Be yourself

- Principled confrontation

Airbnb

- Be a host.

- Every frame matters. (referring to storyboarding)

- Simplify.

- Embrace the adventure.

- Be a ‘cereal’ entrepreneur.

- Champion the mission. (The mission is to feel like you’re home anywhere.)

Miscellaneous Notes

Travis Kalanick’s History

- In high school, Kalanick sold Cutco knives and started an SAT training company after graduation.

- In 1998 he dropped out of UCLA senior year to join classmates building Scour.net, a search engine for media files on local networks.

- In 1999 Scour was getting 1.5 million views a day and 900k visitors in two months.

- A few “nonlucky” events happened: Michael Ovitz dragged out an investment offer, sued them, and acquired 51% of the company; in 2000, Scour was sued for $250 billion and declared bankruptcy fall of 2000.

- In 2001, Kalanick started Red Swoosh, a company offering to save bandwidth costs for media companies by P2P distribution.

- Within a year his co-founder left, poached the engineers, and Travis was alone watching deals fall through.

- In 2005, Mark Cuban invested $1MM, and Travis moved to the Valley.

- In 2007, he sold the company to Akamai for $18.7MM, netting him several million after years of labor.

- Kalanick wasn’t sure about joining Uber for over a year. He was contemplating joining Formspring, a Q&A site he’d invested in, as COO.

Facing Fire from Earlier Advocates

Airbnb

- Some Airbnb hosts were upset by the lack of disclosure around local regulation and that their hosting might be illegal. Nigel Warren was fined for $40,000 and, receiving little help from HQ, got exposure through the New York Times. Eventually, with some legal assistance from Airbnb, Warren was excused of charges.

- Guests reported racial discrimination.

Uber

- Drivers continuously combated over 1099-contractor status, and over reduction in fees designed to stimulate demand and fight Lyft.

Reacting to Crises

- Defense and blaming the user will only stoke the fire.

- Paul Graham: “Fall on your sword, accept responsibility, and people will move on.”

- Chris Sacca: “You can’t say out loud, ‘Fucking get over it,’ you have to be like, ‘We are working on it, good feedback, we’ll improve the app.’”

- In response to the EJ incident, Chesky writes “we have really screwed things up” and appended his personal email to the letter. Read the original letter.

- In response to 7x surge pricing, Kalanick tweets defensively, arguing the price is always visible.

Miscellaneous Notes

- Negative churn

- Uber saw that users who joined were more likely to stay with it and increase their usage over time.

- Forcing good host behavior

- A challenge was getting hosts to reply to guests’ messages. The solution was to make the host’s response rate publicly visible (eg “this host responds to 50% of messages”), thus affecting their chance of being approached.

- Arguments and analogies

- “Ridesharing will cause terrible accidents to uninsured drivers.” “That’s like restricting wireless phone service because people are afraid they’ll be cut off from 911 if their cell phone batteries die.”

- Both took advantage of macro economic trends.

- During the 2008 recession, an open inventory of rental properties allowed managers like Toshi Chan to snap up cheap apartments and re-list them nightly.

- Uber benefits from shaky employment.

Notable Quotes

“If you want to build a truly great company you have to ride a really big wave. And you’ve got to be able to look at market waves and technology waves in a different way than other folks and see it happening sooner.” - Greg McAdoo, Sequoia

“Everyone is going to give you advice. Ask for the story behind the advice. The story is always more interesting.” - Travis Kalanick

“Don’t worry about competitors; startups usually die of suicide, not homicide.” - Paul Graham.

Kalanick, after Scour went bankrupt: “I was playing the game I call ‘fake it till you make it.’ Basically fighting reality. When you do that too long, when you are in failure state, it will eventually crush you.”

“Bleeding Uber Blood” - Travis Kalanick, in company emails.

“This is what we do. You Americans innovate. Me and my army of ants, we go fast and build great operations.” - Oliver Samwer, head of Rocket Internet, in threat to AirBNB

“They just want to see you suffer. They want an ounce of blood. Just fall on the sword, accept responsibility, and everyone will move on.” - Paul Graham to Chesky, during EJ’s house ransacking ordeal.

“This is going to be the best deal of your life.” - Chesky to Oliver Jung, hired to lead international expansion.

“We need more fucking cars!” - Kalanick to Matthew Kochman on New York City’s driver shortage.

“He came to us and said, ‘Look, we are internationalizing and launching in Paris,’ and every single engineer was saying, ‘That is not possible, there is so much work, we will never be able to do it.’ But we got it done. It wasn’t perfect. But that was one of those moments where I was like, ‘This Travis guy, he is really showing us what is possible.’” - Conrad Whelan, Uber’s first engineer.

“I’m going to literally flip this table if anyone says one more time they are worried about destroying the brand. The luxury of Uber is about time and convenience. It’s not about the car.” - Kalanick, in response to concerns about bringing taxis into Uber and diluting the brand.

“The great companies, the PayPals of the world, don’t get scared by regulation.” - Kristin Sverchek, Lyft’s counsel.

On meetings between Chesky and Kalanick: “Brian would come back saying, ‘We have to be tougher!’ and Travis would come back saying, ‘We have to be nicer!’”

“The minute your car becomes real, I can take the dude out of the front seat. I call that margin expansion.” - Kalanick, on Google’s self-driving car.

“Grow really, really fast. You either want to be below the radar or big enough that you are an institution. The worst is being somewhere in between.” - Chesky, on how to combat regulation.

“You need to be willing to partner with cities and tell your story. We found the most important thing to do is to go and meet city officials...It’s hard to hate up close.” - Chesky, on how to combat regulation.

“When this community is empowered to be a movement, we cannot be beat.” - Airbnb head of policy Chris Lehane, at Airbnb open, to hosts.

“We could tell from the way they looked at us that they thought of us as just another local taxi app from Sichuan. Foreign companies see China as a territory to be conquered.” - Cheng Wei, Didi founder, on meeting with Kalanick and receiving his offer to cede China for a 40% stake

“If we fail, we will die.” - Cheng Wei to Didi employees

“The things that people are going to feel are still to come. The kind of impact this is going to have on our cities—ninety-five or ninety-eight percent of it is still yet to happen. What if I said there’s going to be no traffic in any major city in the U.S. in five years?” - Kalanick